45% Indians fear inflation never normalizing; household expenses expected to rise in 2025

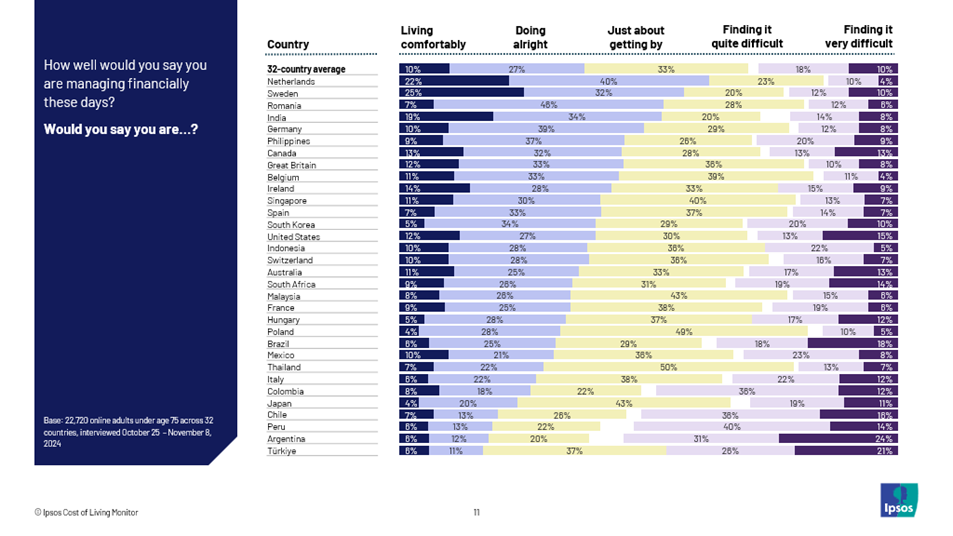

Mumbai: Ipsos Cost of Living Monitor November 2024 shows Indians displaying a good coping mechanism financially vis-à-vis other global markets, with 19% claiming to be living comfortably, 34% claiming to be doing alright, 20 per cent just about getting by, and only 22% finding it difficult to cope.

Further, 4 in 10 urban Indians (40%) say they are better off than 2020 when the country was in the midst of the covid19 pandemic, 25% see no change and 19% believe they are worse off.

Attitudes towards Inflation

Citizens are wary of inflation never turning normal with 45% expressing this view. 20% were hopeful of inflation normalizing after the next year, 12% expect by next year, 9% in 6 months, 6% in next 3 months and 7% felt it has already normalized.

Looking at the solutions for combating inflation, Indians displayed polarized views for whether the govt should cut taxes for individuals and spend less on public services like education and healthcare (28%) or govt should increase spends on public services, even if it entails citizens paying more taxes (28%).

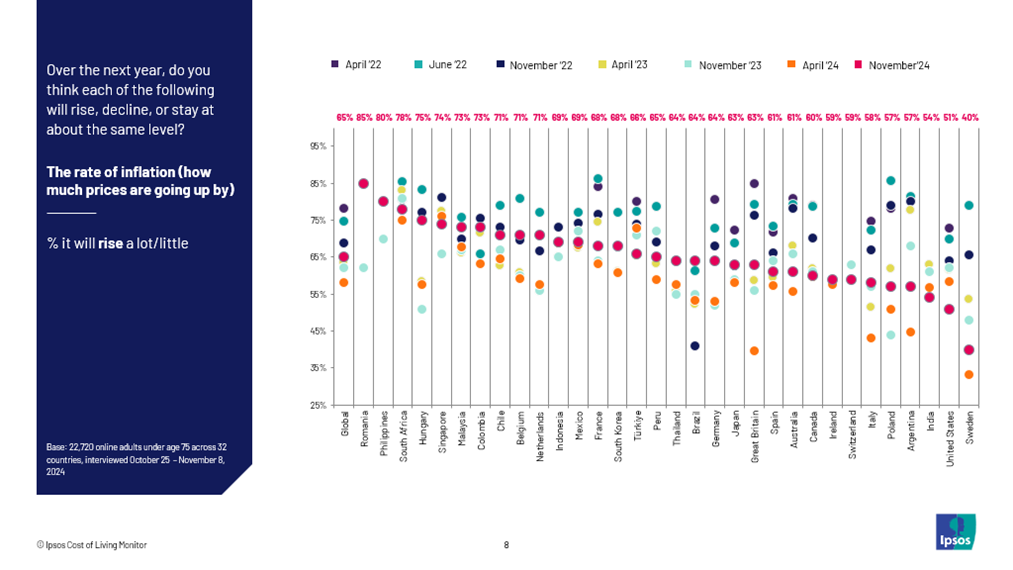

1 in 2 urban Indians (54%) expect Inflation to continue to rise through the next year, with 65% of global citizens too expecting cost of living to rise through 2025. Further 24% Indians and 23% global citizens expect their standard of living to fall in the next one year due to the rising inflation.

There is a lurking fear of rise in taxes, interest rates and unemployment rates in the next year.

Why is the cost of living going up?

Citizens believe multifarious reasons could be contributing to the rise in cost of living.

Workers demanding pay increases (55%); businesses making excessive profits (54%); interest levels in the country (53%); policies of the national govt (52%), Russian invasion of Ukraine and its consequences (52%), immigration into the country (51%), covid19 pandemic (50%) and the state of the global economy (50%).

Ipsos Cost of Living Monitor, a 32-country global advisor survey how consumer feel about inflation and how much it is impacting their present situation and how the impact is likely to be felt in future.

Crystal Ball into the future of Cost of Living

22% Indians fear disposable incomes declining over the next year.

And households spends over the next 6 months are likely to rise for a plethora of areas believe citizens: 62% expect rise in food prices; 61% expect rise in cost of utilities like gas, electric etc; 61% expect rise in cost of other household shopping; 59% Indians expect rise in motoring fuel costs like diesel, petrol, gasoline etc; 56% expect the overall cost of going out, socialising like cinema, cafes, restaurants, pubs, clubs, to rise; 53% Indians believe the overall cost of subscriptions will rise; and 56% expect the cost of rent/ mortgage to increase. Global average was lower at 44%.

“High cost of living has been both an urban and rural phenomena and has added pressure on household budgets and discretionary spends of citizens. While the world was still in the recovery mode after the gruesome pandemic, the wars in Ukraine and Gaza have further slowed down the global and local economies and upset household budgets with prices of essential commodities continuously rising. India, due to its population dividend and a large reliance on domestic consumption is better off than most of the markets covered in the survey. Even on inflation, India is placed amongst the lowest. More number of Indians claimed to be coping well, or just about getting by,” stated Amit Adarkar, CEO, Ipsos India.“Free rations for the poor, subsidy in dava khanas run by the govt, keeping oil prices in control, Ayushman Bharat Pradhan Mantri Jan Arogya Yojna, have all softened the blow of high cost of living on the economically weakened and the masses,”